Customer success

NIBank Implements

Temenos Transact

North International Bank partners with SG NewTech for the first ever cloud-based, serverless implementation of Temenos Transact.

Credit Origination And Appraisal

Test Your Digital Maturity

How does your business compare to your competitors?

Score your credit process against our Digital Loan Origination Compass!

SG NEWTECH PRODUCTS

PRIORITY ERP

Experience the most effective workflow with the leading enterprise resource planning software solution.

Who we are

SG NewTech is a technology solution company that works with financial institutions (Banks, MFIs, Credit Unions and Fintechs) to implement and to deploy the banking platform of the future.

Core transformation

for banks and MFIs

Credit origination, credit appraisal and credit decision solution

Core transformation

for banks and MFIs

AND SUPPORT

Core transformation

for banks and MFIs

Credit origination, credit appraisal and credit decision solution

Core transformation

for banks and MFIs

Key differentiators

DEEP DOMAIN KNOWLEDGE

TRUSTED ADVISOR

experienced in digital transformation

COMMITMENT

to quality, project timeliness, innovation and long term partnership

CERTIFIED CONSULTANTS

with multiple language skills

EMERGING MARKETS EXPERIENCE

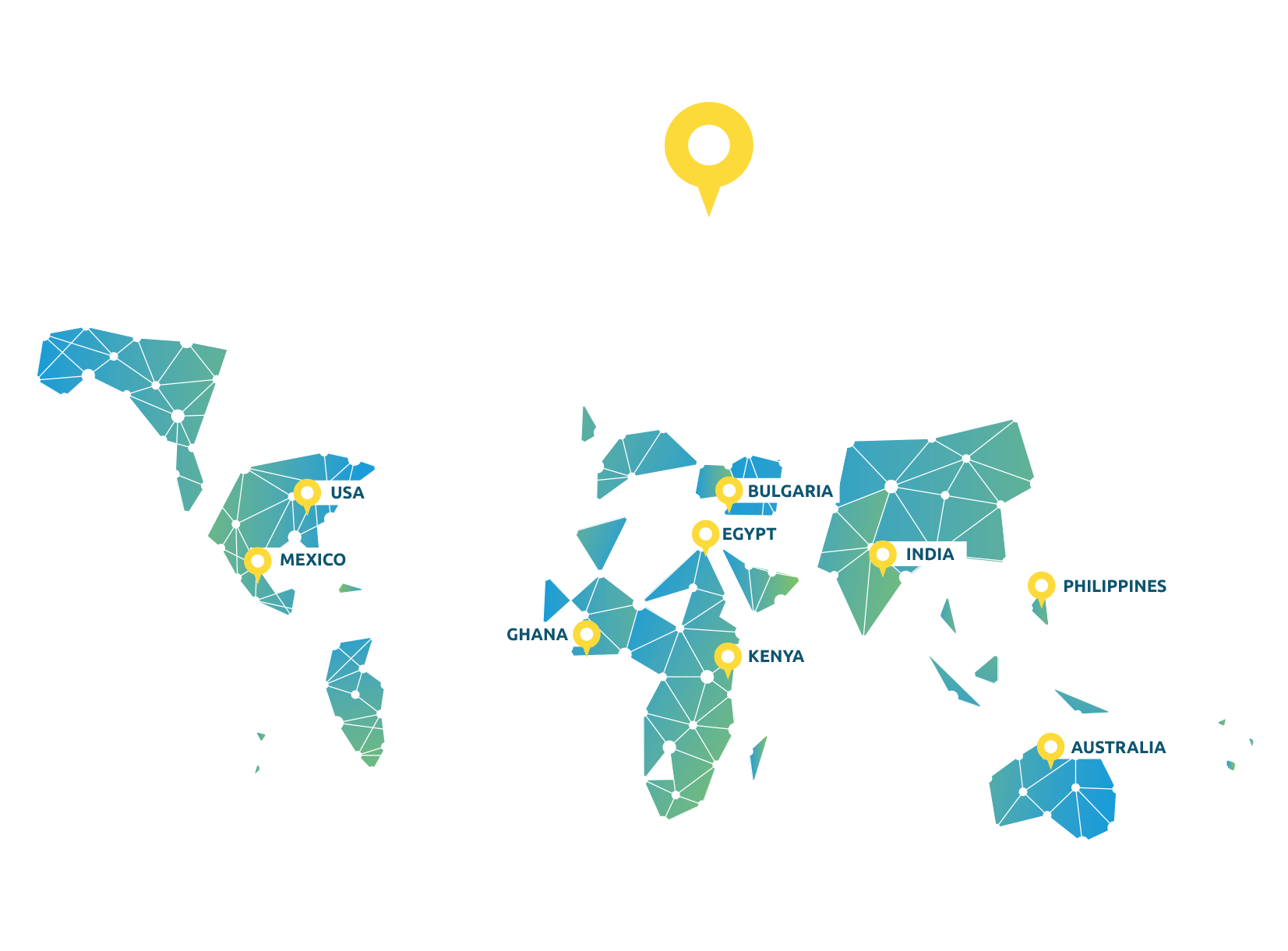

across Africa, ECA, MENA, LATAM, APAC

Driving Digitalization for

Financial Service Providers Worldwide

Driving Digitalization for Financial Service Providers Worldwide

Presence in more

than 70 countries

Customers

Worldwide

Projects

People’s lives

impacted

Clients

SG NewTech supports various type of customer – banks, MFIs, Saccos, Fintech of different sizes in different geographies

with innovation solutions and services. The following are a few examples where SG NewTech made a contribution to their

technological evolution.

Testing service from SG BankTech to

support upgrade of Temenos CBS;

development of e-Alert solution

Talent augmentation for the

development of internet

banking platform

Bank Antigua (Temenos Transact

implementation on AWS)

Ongoing support of Temenos T24

and deployment of e-statement solution

Implementation of

Fusion CreditQuest

Ongoing support of CreditQuest

Implementation of DigiWave Agency Banking and integration to T24 CBS

Implementation of DigiWave Internet Banking and integration to T24 CBS

Implementation of CreditQuest, ongoing support and integration in Kenya and 5 subsidiaries

Testing service from SG BankTech to

support upgrade of Temenos CBS;

development of e-Alert solution

Talent augmentation for the

development of internet

banking platform

Bank Antigua (Temenos Transact

implementation on AWS)

Ongoing support of Temenos T24

and deployment of e-statement solution

Implementation of

Fusion CreditQuest

Ongoing support of CreditQuest

Implementation of DigiWave Agency Banking and integration to T24 CBS

Implementation of DigiWave Internet Banking and integration to T24 CBS

Implementation of CreditQuest, ongoing support and integration in Kenya and 5 subsidiaries

NEWS & RESOURCES

North International Bank (NIBank) Implements Temenos Transact with SG NewTech to Unleash Innovation

North International Bank (NIBank) in Antigua and Barbuda has completed its Temenos Transact core banking implementation project in partnership with SG NewTech.

Creating a Positive Project Environment: 5 Tips That Drive Results

A project’s environment plays a crucial role in shaping its outcome. It encompasses factors such as organizational culture, leadership support, team dynamics, and resources.

Temenos Community Forum 2023

On May 9-11, join SG NewTech’s CEO, Tunde Oladele at TCF2023. Temenos Community Forum is a great chance to meet with more than 1,500 of the